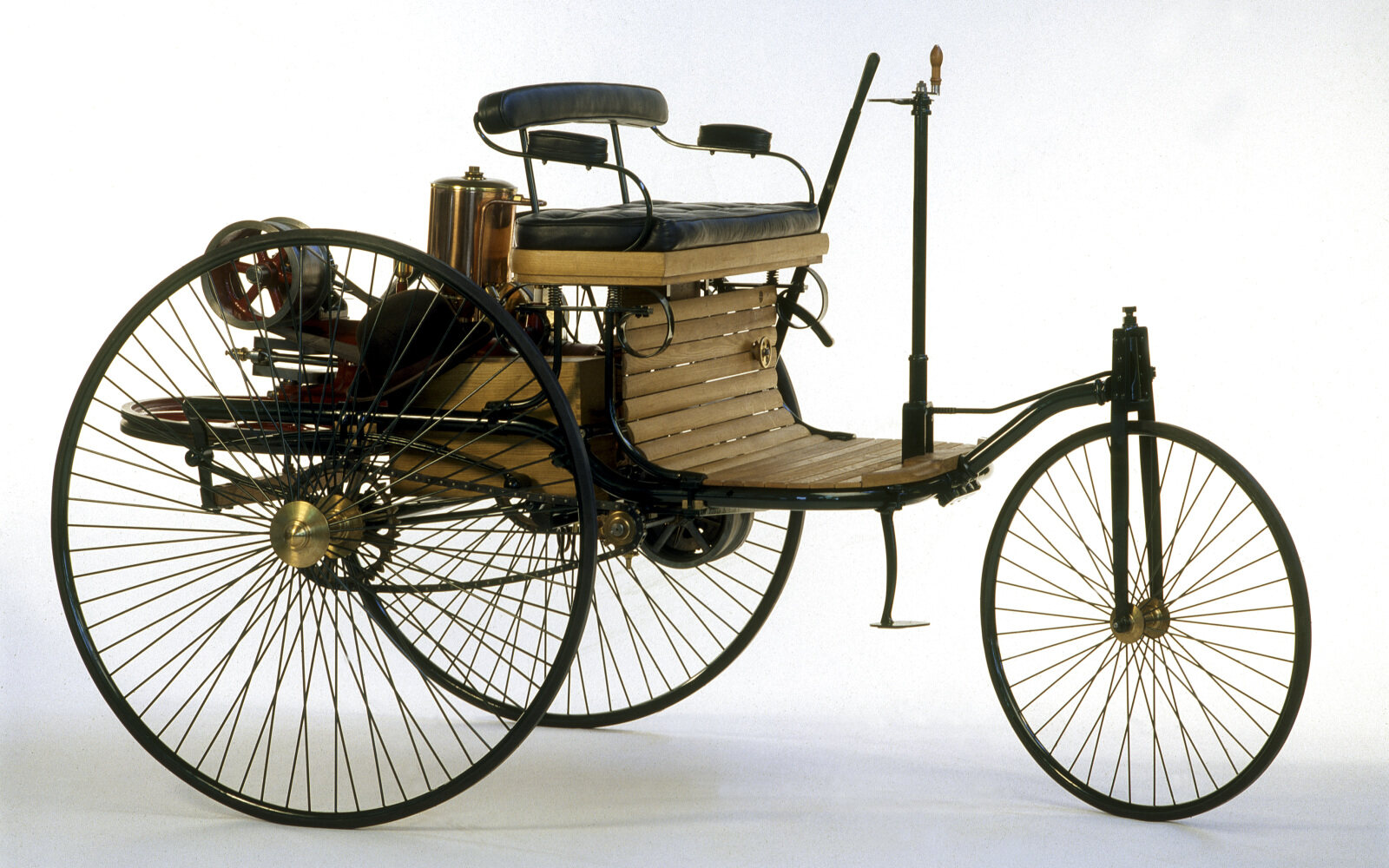

In July 1886, Carl Benz’s patent – number 37435 – could be regarded as the birth certificate of the automobile, and when newspapers reported the first ever outing of ‘Benz Model No.1’ announcing a ‘vehicle powered by a gas engine’ and that changed human history.

Since then the ‘car’ has become so much more than it’s collection of parts, throughout its development capturing what was ‘state of art’ at any point in time. From purely mechanical, to today’s era of computerised controls and self-driving, safer for occupants, pedestrians, and the environment.

All cars evoke emotion, good or bad, many define their own sub-cultures, some even inspired their own hit songs and entire movies, and skewed by these passions, value is assigned.

Trading in vehicles naturally occurred, as a secondary ‘used’ market evolved as primary owners decided to purchase better equipped, better evolved and of course faster vehicles.

Collecting and investing in vehicles quickly grew as appreciation of the performance, rarity and history of specific marques and models, thanks in the most part to motorsport, as truly gladiatorial drivers such as Ascari, Fangio, [add more drivers] and Moss, gave brands such as Auto Union, Aston Martin, Lotus, Mercedes and Ferrari legendary status and created a unique glamour and soul to the art of driving.

Sotherby’s are said to be the first to recognise that growing trend, holding their first auction of collectible cars in 1970. Others followed swiftly, soon joined by specialised dealers. Today’s market has evolved to 50 significant auctions, and ~200,000 classic car events around the world each year indicating the level of interest in classics cars as an increasing as ‘life-style’ choice.

As the market became most established of course all classic car owners developed a close relationship to the value of their car. Price appreciation over time is undoubtably why we can justify our ownership and love these vehicles in any sensible way.

The price appreciation has had a virtually uninterrupted positive performance over >30 years. An estimated market-size for the ‘Top 100’ historic collector car models is ~$23-35bn. More broadly the entire market of ‘road eligible cars’ (excluding pure racing specials and prototypes) is approximately ~$38bn.

A great example of this price appreciation has be Warren Buffet’s account in his book ‘The Snowball’. Buffet was invited to purchase a Reno landmark ‘The Harrah Collection’ following Bill Harrah’s death. The collection consisted of 1400 cars, such as [list some cars with photos], are now thankfully still situated in Reno (https://automuseum.org), but the collection reduced significantly to ~200 cars. (Worth visiting if you are ever in the area!)

The hotels, casinos and that car collection were eventually sold to Holiday Inn hotel chain who promptly moved to sell off the car collection. The complete sale of the collection was only halted by public outcry, the support of many individuals, and the Nevada State Government. By then many 100’s of truly historic and rare vehicles found new homes, drip-fed through auctions, the result was a staggering $69m.

The real surprise though, at todays values this would amount to an inflation adjusted $298m (in actual fact, the value would be higher than the crude inflation adjustment applied here). Mr Buffet however, didn’t decided to strike this deal, he passed on it, which he obviously regretted!

At the National Automobile Museum, The Harrah Collection, in downtown Reno.

— NatlAutomobileMuseum (@NatlAutoMuseum) November 11, 2010

...See the abstract Picasso Car... http://fb.me/ubXywyZo

Becoming Alternative Investments

This is a good example of why today, many high net-worth individuals, family offices, and even professional investors and hedge funds can be found using the services of specialised classic car dealers, to secure investment grade vehicles.

In investment terms a historic motor car is a ‘non-correlating’ ‘alternative investment’ to traditional assets such as Stocks or Bonds, where the risks to these assets caused by economic impacts can practically decimate a trading portfolio permanently, are not typically a worry for well informed collectors (the same can be said to a lesser extent, for Art and Wine).

In fact the majority of collectable cars have even out performed property during the COVID crisis.

The majority of investment property has shown to be a more risky asset to hold, and many properties are becoming catastrophic liabilities for their landlords as the government rightly acted to protect tenants, from eviction for non-payment of rent during the crisis. The result wad many landlords covering the entire costs of assets that are said to decrease in value as we head into what could be a significant post pandemic recession.

Take a look at the key positives of the market and owning a collectible car argues for a break away from traditionally unpinning your wealth strategy with just property, commodities, stocks, and bonds:

• Mostly uninterrupted positive performance over >30 years, thanks to limited supply and strong demand.

• Capital protected from inflation and taxation.

• Non-correlative characteristics with other asset during economic stresses and turmoil.

• Eligibility to vintage events; you enjoy your car as it was intended, but collectors typically buy vintage race cars to enter historic events as are cars that can be designed to be driven on the street, but are competitive on the track too. In most cases expect to pay a premium.

• Originality is paramount, especially in historic racing due to the Historic Technical Passports and FIA Heritage Certificates. Cars must retain mechanical systems that belonged to the car of the period.

Now if you’re still reading you are obviously interested in collecting an historic car, and the good news is you don’t need to rush out and buy the first Ferrari you can find to make great investments. When you select the right car, you will see an appreciation of that asset over time.

With more and more cars are gaining collector status picking the ‘right one’ is deeply satisfying.